New Blog Post

Most trading mistakes don’t come from bad intentions. They come from hidden assumptions.

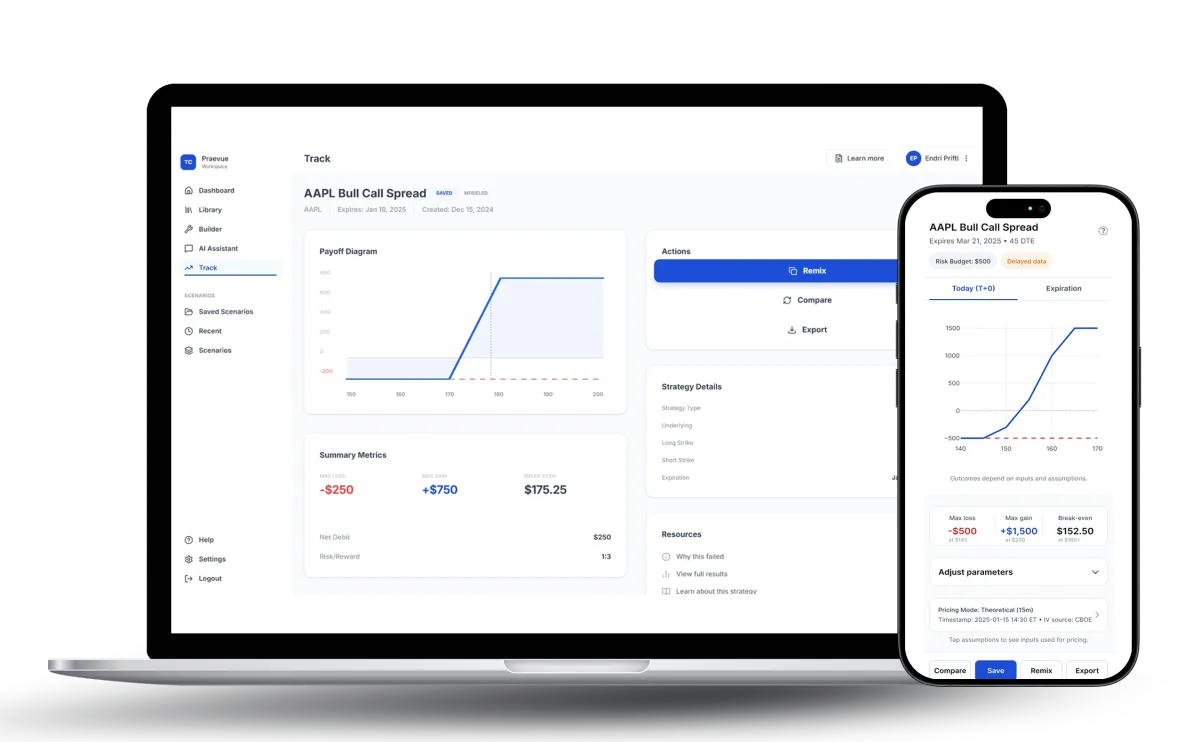

Before any scenario is placed in the real world, it already relies on inputs: price, time, volatility, and structure. When those inputs are unclear, outcomes feel surprising instead of explainable.

Modeling outcomes first helps you slow the process down. You can see how a scenario behaves if the price moves quickly, slowly, or not at all. You can observe how time decay affects the result as expiration approaches. You can also understand how volatility changes can reshape risk.

This doesn’t predict the future. It simply shows what the model assumes today.

By reviewing outcomes and assumptions together, you build a clearer mental map of how scenarios behave. Over time, patterns become easier to recognize. Not because you followed signals, but because you understood the structure.

That clarity is the real value of modeling before committing capital.

Educational tool. Not investment advice.